From W-2 to 1099: Tips for a Smooth, Successful Shift from Permanent to Locum Tenens

Transitioning from a W-2 role to a 1099 locum tenens position marks an exciting shift in a physician's or advanced practitioner's (APPs) career. With it comes greater freedom, flexibility, and control over both your schedule and earning potential.

However, increased autonomy also brings added responsibility, especially when it comes to financial planning. Understanding the key differences between W-2 employment and 1099 contracting is essential to navigate this transition smoothly and set yourself up for long-term success.

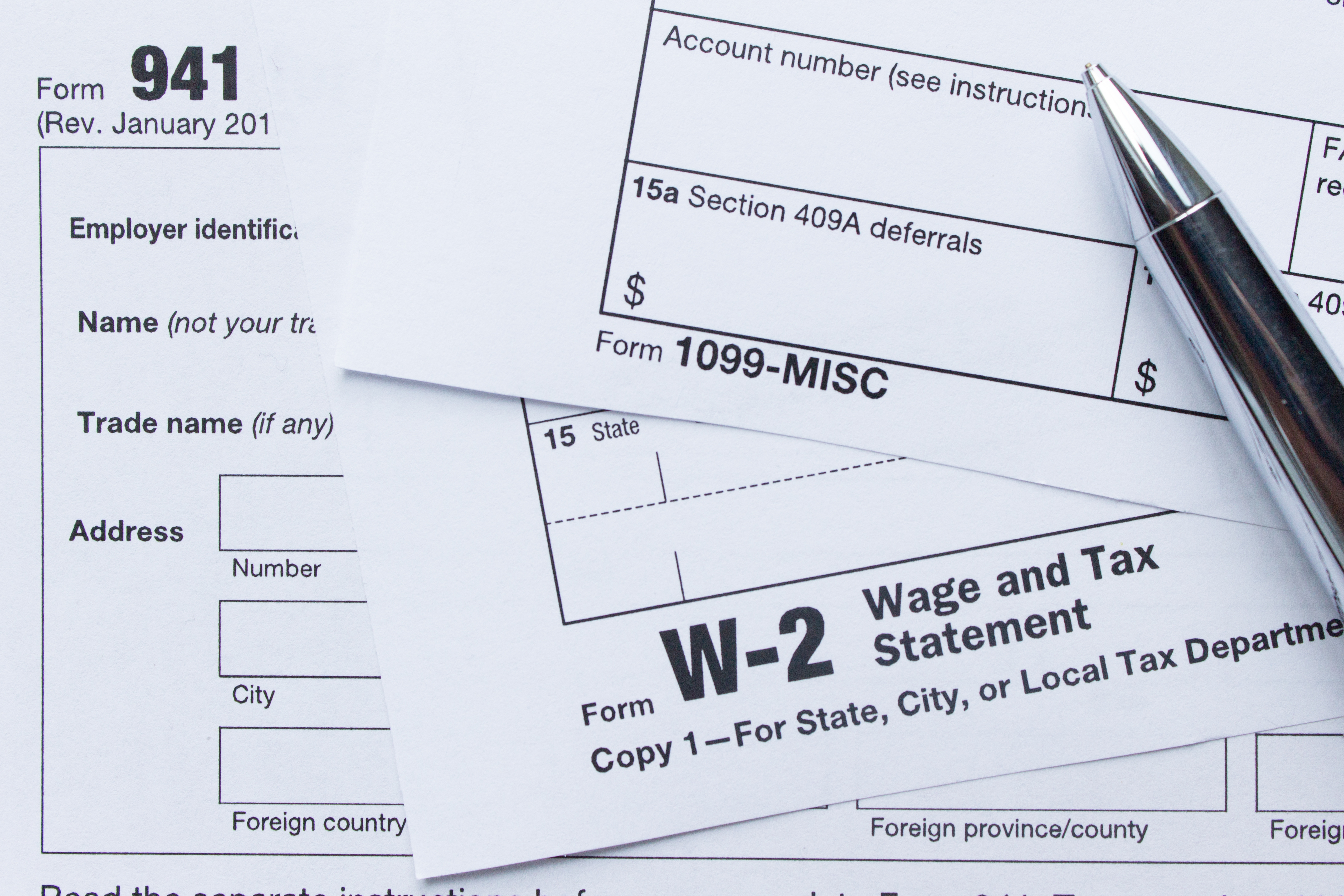

What is the Difference Between W-2 and 1099?

The differences between W-2 and 1099 include the way taxes are handled, the level of control over work hours and assignments, the benefits package offered, and more.

Here are the major differences between W-2 and 1099 locum tenens:

1. Tax Forms

1. Tax Forms

A W-2 form is given to employees who work directly for a hospital, group, or other healthcare facility and typically have their taxes automatically withheld from their paychecks by their employer. A 1099 form is used by independent contractors or self-employed individuals. 1099 locum tenens are responsible for paying their taxes directly to the government.

2. Benefits

W-2 employees typically receive employer-sponsored benefits such as health insurance, retirement contributions, and paid time off. In contrast, 1099 locum tenens physicians and advanced practitioners are considered independent contractors and are not eligible for these traditional employee benefits. Instead, they have the flexibility to choose their own health coverage through the insurance marketplace or private providers, often tailoring plans to better fit their lifestyle and needs.

3. Malpractice Insurance

As a W-2 physician or APP, you are covered under your employer's malpractice policy. As a 1099 locum tenens physician or advanced practitioner, you must obtain your own malpractice insurance.

4. Employment Contract

As a W-2 physician or advanced practice provider (APP), you are employed by an organization under a formal contract that outlines your salary, benefits, responsibilities, and other terms of employment. In contrast, as a 1099 locum tenens physician or APP, you must establish a separate agreement with each healthcare facility for every assignment. This contract will include the duration of the locum tenens assignment, the duties you will be expected to perform, the rate of pay, and other conditions, such as reimbursement for travel expenses.

5. Work Flexibility

W-2 physicians and advanced practitioners typically follow a fixed schedule determined by their employer. As a 1099 locum tenens provider, you control when, where, and how often you work. This flexibility allows you to align your assignments with your personal priorities, professional goals, and ideal work-life balance.

6. Compensation

As a W-2 employee, your salary will normally grow with the length of your employment. Hospitals typically utilize the MGMA Physician Compensation and Productivity Survey and market data to determine competitive market compensation. When working as a 1099 locum tenens, you'll receive competitive compensation based on your specialty, location, and duration of the assignment. You'll have the ability to earn more money by taking on additional assignments or working in locations with a higher demand for your specialty.

Making the Transition from W-2 to 1099

Here are a few tips on how to make your transition from a W-2 physician or advanced practitioner to a 1099 locum tenens efficient and stress-free.

1. Set Up a Separate Business Entity

When embarking on the switch from permanent employment to locum tenens, it is always a good idea to form a legal entity, such as an LLC or professional corporation. Opening a separate business entity helps protect your personal assets. In addition, it also allows you to take advantage of certain tax benefits.

Medicus, a leading locum tenens agency, has an exclusive partnership with legal support professionals to ensure that our physicians and advanced practitioners can access expert guidance when setting up their own legal entities.

2. Know Your Tax Payment Schedule

It is important to familiarize yourself with the tax requirements of a 1099 contractor. You will be responsible for paying your taxes quarterly, including your self-employment and income taxes. As a 1099 locum tenens, you must manage your finances carefully; this includes tracking all meals, license fees, subscriptions, tools, clothing, etc. You can deduct various expenses when filing your taxes, such as travel, clothing, meals, mileage, licensing, board fees, and more.

Medicus has partnered with a company that offers professional tax support and quarterly reminders to help you stay on track each step of the way! Our partner offers free tax preparations to ensure you take advantage of all the deductions and credits available.

3. Start Building Your Financial Plan

Transitioning to 1099 work means taking full ownership of your finances. Budgeting, saving, and planning for taxes become essential. Medicus connects locum tenens physicians and advanced practitioners with trusted financial professionals who can help create personalized strategies that align with your income, lifestyle, and long-term goals.

4. Update Your Health Benefits Insurance Plan

When switching to a 1099 locum tenens position, you are not provided health benefits by your employer. However, when you partner with Medicus for your locum tenens career, you have exclusive access to customized benefits and resources through our partner. They offer affordable individual and family health insurance plans.

5. Secure Malpractice Coverage

Before starting any locum tenens assignment, it is essential to have malpractice insurance in place. If you partner with a locum tenens agency like Medicus, coverage is typically provided on your behalf. Medicus offers comprehensive claims-made and prior acts coverage through an A-rated insurance carrier, ensuring you are protected while working on assignment.

6. Complete the Credentialing and Licensing Process

Before beginning a new locum tenens assignment, you need to be licensed in the state where you would like to practice and credentialed at each hospital or medical facility where you will work. Medicus streamlines and expedites the entire credentialing and licensing process. Our team ensures you have all of the required documents and information ready before each locum tenens assignment start date. Medicus always pre-populates your applications, saving you hours of valuable time. We aim to make the process seamless so you can focus on patient care.

For detailed licensure timelines and costs, access our Physician Licensure Fees and Timelines by State Guide and our APRN Licensure Fees and Timelines by State Report.

Partnering with a Reputable Locum Tenens Agency

When you partner with Medicus Healthcare Solutions, shifting from a W-2 employee to a 1099 locum tenens can be made easier. We offer comprehensive services to help you navigate the transition to a locum tenens career as effortlessly as possible.

With support from Medicus, you can confidently take the steps necessary to successfully transition from a W-2 employee to a 1099 locum tenens physician or advanced practitioner. It is important that you always consult with a tax professional, employment attorney, or business advisor.

Contact us today for more information on successfully transitioning from W-2 to 1099.